- SDCL Energy Efficiency Income Trust has taken on significant assets since its 2018 IPO and has broadened its portfolio

- The evolution of the portfolio and its competition is worth considering

From the promise of attractive yields to shares trading at sometimes eye-watering premiums, the 16 investment trusts in the Association of Investment Companies‘ (AIC) Renewable Energy Infrastructure sector have much in common. But much like any equities that fit into a green infrastructure portfolio, they come in many different shapes and sizes. While better known names such as The Renewables Infrastructure Group (TRIG) invest in a diversified portfolio of renewable energy assets, newer entrants to the space often take a more specialist approach.

Examples include solar funds, energy storage trusts and portfolios with a focus on energy efficiency. In the latter case, teams often focus on reducing energy usage or making an asset more energy efficient, in exchange for contractual service payments. As with other renewable energy investments, doing this should produce a high and fairly predictable income.

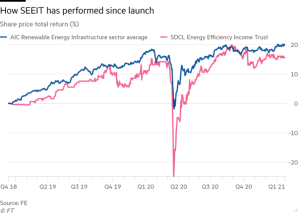

SDCL Energy Efficiency Income Trust (SEIT), the first of the UK’s closed-ended funds to focus here, has had a successful run since its December 2018 initial public offering (IPO). The trust’s shares delivered a total return of 15.5 per cent from 11 December 2018 to 25 January this year according to FE, putting it not far behind the 20 per cent average from its AIC sector. These figures should be viewed in the context of new trust launches, where it can take time to establish a portfolio and generate returns.

In a difficult 2020, the trust’s shareholders made a modest total return while the trust’s portfolio registered a small net asset value (NAV) gain. Having weathered the volatility of last year, the trust’s shares recently traded at a 5.7 per cent premium to NAV, roughly in line with their 12-month average.

The Covid-19 pandemic has meant relatively little disruption to the portfolio itself, which includes a variety of projects from solar assets for supermarket Tesco (TSCO) to Stockholm’s gas grid. In an update in December the team noted some “minor” disruption, including a temporary pause of its work for Tesco.

The same applies to the fall in power prices last year, something that can have a significant negative impact on those trusts that have to sell energy in the market. Jonathan Maxwell, the founder and chief executive of the trust’s investment manager, SDCL, notes: “We have relatively limited exposure to power prices, and normally it’s mitigated through a contractual agreement. By and large our UK portfolio has no exposure. In Europe we have one portfolio project in Spain where we do have in the very short run some exposure to movements in commodity prices. But there is a market mechanism in Spain that compensates for those fluctuations. We don’t have unmitigated exposure to power prices.”

Expanding the portfolio

Covid-19 disruption aside, the investment team faces many of the same challenges and opportunities as its peers in the renewable energy infrastructure sector. This includes a desire to diversify the portfolio, both beyond the UK and into some of the promising sectors of the future.

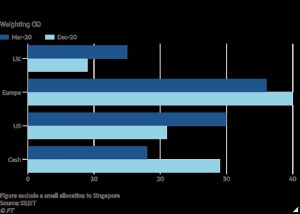

Mr Maxwell has in particular focused on the opportunities appearing in the US – even if this allocation appeared to dip slightly in 2020 (see chart). The country represented 21 per cent of the portfolio in December 2020, with weightings of 40 per cent to Europe, 9 per cent to the UK and 29 per cent to cash, with a small allocation to Singapore.

“The US has been a very substantial market for us,” he says. “It’s a massive economy and energy efficiency might be a small part of the story but it’s big because of the scale and maturity of those markets. The momentum already in place in the US should mean the US continues its growth. With what’s happened on the ground at state and corporate level there has been a big drive to cheaper, cleaner energy solutions. To the extent that Joe Biden is successful, that will add federal support. That will create a larger pool of investments.”

Speaking in late 2020, Mr Maxwell noted that the trust had some 260 projects in the US with a chance that this number could double in the next six months or so. Since then the trust’s board has announced further projects in the country, with the acquisition of a set of solar and energy storage projects, as well as a 50 per cent stake in the financial institution behind them, for around $150m (£109.24m).

The opportunities in the US form part of a broader narrative from 2020: with governments around the world looking to stimulate economies back into action with extensive spending, many plan to splash the cash on green infrastructure projects. This extends from stimulus in the US to Boris Johnson’s 10-point plan for a “green industrial revolution” and the European Union’s (EU) enormous Recovery Fund.

“We’ve seen a completely different policy map drawn by the European Commission and the Biden administration and, to some extent, UK plc,” says Mr Maxwell. “If I summarise it from our point of view, the general message is the next 10 years won’t look that much like the past 10 years.”

Mr Maxwell believes that the Recovery Fund should create big opportunities in Europe for the trust and its investors, with extensive capital required to renovate public buildings.

“Some [of that capital] will come from the European Commission, but most of the money is expected to come in from the private sector,” he says. “I think stimulus will help get the projects going, and de-risk them. But it will rely on private investment more than public investment.”

The manager is less obviously excited about the prospects for the UK, an investment region clouded by uncertainty as it moves on from decades of EU membership.

“I’m not downbeat on the UK, clearly, but there will be a different regulatory environment this year,” he says. “That will have an effect, perhaps positive as well as negative, on the rate at which it can grow.”

That said, the team can still find investments in the UK, some of which are in more exciting sectors. Last year the trust made its first investment commitment to electric vehicle (EV) charging infrastructure, acquiring 112 charging stations for a sum approaching £50m as part of an agreement with Electric Vehicle Network (EVN). For Mr Maxwell, this should mark the beginning of something longer.

“It seems certain the EV market will grow: the question is how to invest appropriately. The partnership with EVN means we can put capital to projects where they have secured locations across the country. Our counterparty will be the operator and not the consumer.”

The risks

The income from SDCL Energy Efficiency Income Trust’s portfolio should remain steady, while the performance of infrastructure assets still appears fairly uncorrelated to whatever happens in economies and markets. With the trust’s shares recently trading on a dividend yield of 5.1 per cent, this remains an attractive play.

However, investors should remember the risk that comes when demand pushes up prices. This has happened not just with infrastructure trust shares, but also with the assets they look to buy. For SDCL Energy Efficiency Income Trust’s management team, which looks not just to enhance the value of its existing investments but also to make acquisitions, overheating in the market has demanded extra due diligence.

“There has been such a flood of capital into high-quality infrastructure investments in 2020 and such a hunt for yield, that it has increased the onus on being really highly selective with investments we make and processes we go through to acquire investments,” Mr Maxwell notes. “We have decided not to make quite a significant number of investments. Candidly I would prefer not to have to spend all the time making those decisions but we have to have discipline.”

Another issue is potential counterparty risk, although this appears to be managed relatively well for now. The majority of the trust’s revenues were associated with counterparties of an investment-grade credit quality or equivalent, as of the end of September 2020.

Like other specialist renewable infrastructure trusts, SDCL Energy Efficiency Income Trust will face competition as its specialism draws attention. Triple Point Energy Efficiency Infrastructure Company (TEEC) raised £100m in an IPO last year, and will seek a total return of 7 to 8 per cent, with a targeted dividend yield of 5.5 per cent in its first full financial year. While Triple Point Investment Management may be known for running a social housing investment trust, it does also have a decade of experience in investing in energy efficiency.

Link to Article