Acquisition of a US Commercial District Energy System

General/ 06 April 2021

SEEIT has agreed to acquire a 100% equity interest in a commercial district energy system, RED-Rochester, LLC, (”RED”) from a fund managed by an affiliate of Stonepeak Infrastructure Partners for an equity cash consideration of approximately $177 million.

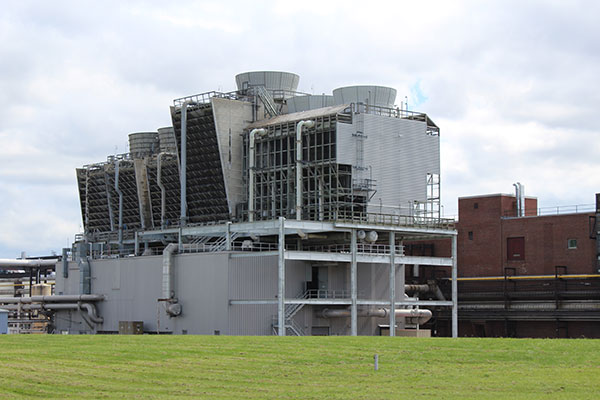

RED is one of North America’s largest district energy systems with 117 MW of steam turbine generators plus boilers, chillers and other equipment that provide exclusive utility services to commercial and industrial customers within the 1,200 acre Eastman Business Park, located in Rochester, New York. The park’s origins date back to 1891 when Kodak started manufacturing film and paper in four newly constructed buildings and is now host to a diversified base of commercial and industrial businesses including manufacturing, chemicals, pharmaceuticals and food and beverages.

As the exclusive provider of utility services to the park, RED offers 16 on-site services including electricity, steam, chilled water, wastewater, compressed air, nitrogen, lake water treatment, industrial water distribution and high purity water distribution. This “plug-and-play” set of utility services is a key attraction of the park, providing simple integration for new customers and allowing existing customers to expand their operations.

RED has over 100 commercial and industrial customers, typically contracted on a 20-year fixed-term basis with automatic five or ten year renewals, linked to their tenancy on the Eastman Business Park. The contracts provide stable and predictable cash flows with substantial mitigation against volatility in demand. Some two thirds of the value of RED’s offtake contracts are derived from investment grade or equivalent counterparties(1). RED’s cost base is relatively fixed, providing good visibility of cashflows.

Since 2016, RED has delivered 40+ energy efficiency projects across its operations that have resulted in annual savings of over $4 million and carbon savings of over 50%. Additionally, the Investment Manager has identified a further pipeline of potentially accretive energy efficiency initiatives that it believes can deliver additional cost and carbon savings.

The acquisition will be funded from existing cash reserves and RCF facilities, which includes the capital raised by SEEIT in the equity fundraising in February. RED’s existing project debt finance facilities, which are equivalent to c.$83 million, will remain in place. Completion of the acquisition is expected after satisfactory conclusion of customary regulatory conditions and consents.

The investment is expected to achieve SEEIT’s total returns objectives and to further support its progressive dividend policy.

Commenting on the acquisition, Jonathan Maxwell CEO and Founder of Sustainable Development Capital LLP, said:

“SEEIT is acquiring an operational and established district energy system that provides a range of essential and efficient energy services and utilities to a diversified customer base on one of the largest business parks in the United States of America. We expect the project to make positive contributions to SEEIT’s earnings and cash flow. At the same time, the project offers the potential for growth over the medium to long term through the addition of new customers and the implementation of accretive energy efficiency measures.”